Summary

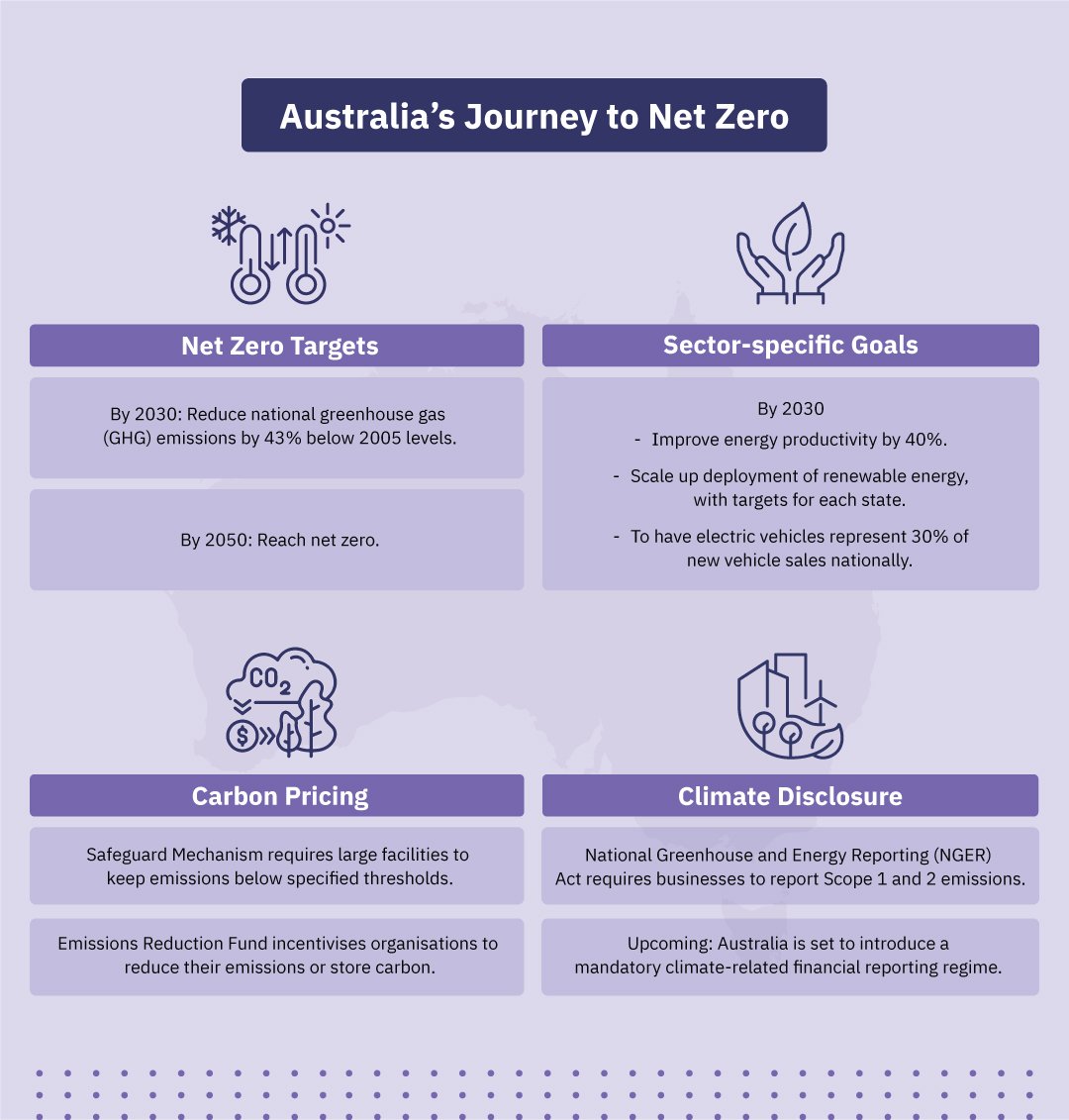

- The Labor Government has set ambitious targets to reduce greenhouse gas emissions by 43% by 2030 and achieve net zero by 2050, urging businesses to adopt decarbonisation strategies.

- Australia's rules around reporting and pricing, like the Safeguard Mechanism, provide revenue opportunities for businesses while requiring compliance to avoid penalties associated with exceeding emissions thresholds.

- Terrascope offers businesses tools to measure, manage, and report carbon emissions, facilitating compliance with evolving regulations and helping create a competitive edge in sustainability efforts.

Introduction

As sustainability takes centre stage on a global level, Australia has emerged as a regional leader in the Asia-Pacific region, committing to establishing climate regulations which are unprecedented in this region. Businesses which operate in Australia must navigate an increasingly complex regulatory framework, which presents multiple potential opportunities and risks. By understanding the implications of net zero legislation, carbon pricing mechanisms and climate disclosure regulations, businesses can gain a competitive edge while contributing to a sustainable future. Terrascope can help businesses uncover the path towards climate resilience.

National targets and Net Zero legislation

In 2022, the new Labor Government doubled Australia’s 2030 emissions reduction target by committing to reduce its greenhouse gas (GHG) emissions by 43% below 2005 levels by 2030. It also set the goal of reaching net zero by 2050.

The national target is also supported at the state and sectoral level. For example, Australia targets to improve its energy productivity by 40% by 2030. It also aims to scale up its deployment of renewable energy – by achieving 100% renewable energy deployment in the Australian Capital Territory and Tasmania, and 50% renewable deployment in Queensland, Victoria and Northern Territory, by 2030. It aims to have electric vehicles represent 30% of new vehicle sales by 2030 nationally, and 50% for New South Wales and Victoria.

These ambitious climate targets make it vital for businesses to prepare accordingly. These represent an opportunity for businesses to use decarbonisation to expand their revenue streams. For example, businesses could pivot towards offering more sustainable products or services. On the other hand, businesses should start taking concrete actions to decarbonise their operations in line with Australia’s national and sectoral targets, to avoid facing regulatory or reputational challenges in the future.

Carbon pricing

Australia has implemented several carbon pricing instruments, which play a pivotal role in supporting Australia’s net zero targets. One of these instruments is the Safeguard Mechanism, which requires large facilities to ensure that their emissions do not exceed specified ‘baselines’ (i.e. thresholds). Facilities which have produced more emissions than these ‘baseline’ thresholds must offset their emissions. From July 2023, facilities that overachieve on their baseline (i.e. produce less emissions than their allocated thresholds) are allowed to issue credits. This makes the Safeguard Mechanism an emissions trading scheme (ETS). Over time, Australia will tighten the ‘baselines’, in alignment with its 2030 targets.

Concurrently, Australia has implemented the Emissions Reduction Fund, which is a voluntary scheme that incentivises organisations to adopt new practices and technologies to reduce their emissions or store carbon. Participating organisations can earn 1 Australian carbon credit unit (ACCU) for each 1tCO2e stored or avoided by a project. These ACCUs can be sold to generate income.

These carbon pricing regulations represent both opportunities and risks for Australian businesses. They could potentially increase costs for Australian businesses, for example if their electricity suppliers are unable to switch to renewable electricity sources quickly enough. On the other hand, businesses can seize this opportunity to present a strong financial case to push for investing in decarbonisation levers early, which may reduce business costs over the longer term. Moreover, businesses could use the aforementioned carbon pricing instruments to sell credits and generate revenue.

Climate disclosure

The third strategy which supports Australia’s climate ambitions lies in driving transparency and accountability among businesses. In this regard, Australia has implemented carbon disclosure regulations which are rigorous, internationally aligned and credible which mandate the measurement and reporting of carbon emissions. These regulations facilitate the transition to a low-carbon economy by encouraging businesses to reduce their GHG emissions, as well as by enabling investors and financial institutions to make more informed decisions on capital allocation.

At a glance, the standards mandate Scope 1 & 2 disclosures for Australian companies, changing in their applicability over time. Assurance also begins to kick in, after year 4, based on Fig 3.

Businesses (in Group I) are expected to start reporting with financial years starting as early as 1 Jan 2025 in accordance with the framework as shown in the table below (see fig 2). NGER reporters are already required to report greenhouse gas emissions, energy production and energy consumption and will fall under Group 1 or 2.

Fig. 2: Phases in timeline and criteria of the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024

Scope 3 emissions are required to be reported from a company’s second reporting year on top of the immediate mandatory disclosure of Scope 1 & 2 emissions. Scope 3 emissions make up the majority of a company’s total emissions and are the hardest to accurately measure and calculate out.

The Treasury Laws Amendment Bill has formalized the Australian Sustainability Reporting Standards (ASRS), consisting of Australian Accounting Standards Board Standard 1 (AASB S1) and Standard 2 (AASB S2). This is aligned with the International Sustainability Standards Board's (ISSB) International Financial Reporting (IFRS S1) Standard 1 and Standard 2 (IFRS S2). The AASB governs these standards, while the Auditing and Assurance Standards Board (AUASB) oversees quality and assurance. AASB S2 mandates climate-related financial risk disclosures, whereas S1 covers general sustainability reporting.

AASB S1 and S2 are different in that S2 is specific to climate-related financial risk, whilst S1 governs sustainability reporting in general. S2 is also mandatory, while S1 is voluntary.

AASB S2, as it pertains to mandatory climate-related disclosures, is what you might be reading this article for. According to the AASB, this Standard, when applicable, requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance, or cost of capital over the short, medium, or long term.

Assurance

After some initial deliberation, the AUASB has also worked with the International Auditing and Assurance Standards Board to implement the AUASB standard, ASSA 5000 General Requirements for Sustainability Assurance Engagements. This will take effect on sustainability assurance engagements on or after 1st January, 2025.

For mandatory climate reporting under the Corporations Act, this takes effect through ASSA 5010 Timeline for Audits or Reviews of Information in Sustainability Reports.

Fig. 2: Phases of assurance requirements as given effect through ASSA 5010 Timeline for Audits or Reviews of Information in Sustainability Reports

In Year 1, assurance requirements are the least stringent, with limited assurance needed only for Governance, Strategy, and Scope 1 & 2 emissions disclosures. These begin to kick in more strongly in Year 2 and 3, with limited assurance needed across all components of a Sustainability Report.

Reasonable assurance starts to kick in by Year 4, with all categories being covered and required.

For continuity, the Australian Auditing and Assurance Standards Board's (AUASB) standard ASAE 3410, which governs Assurance Engagements on Greenhouse Gas Statements, will remain in effect until the start of reporting periods beginning December 15, 2026. This standard will continue to be applicable for distinct emissions reporting as mandated by Australia's National Greenhouse and Energy Reporting Act 2007.

By adopting robust emissions measurement practices, companies not only mitigate environmental impact but also bolster their reputation. Furthermore, compliance with evolving regulations not only minimises legal risks but also fosters trust among investors, customers and regulators. By embracing internationally-comparable disclosure frameworks, businesses can enhance credibility and competitiveness in the global marketplace. In doing so, they pave the way for a more sustainable future while simultaneously driving efficiency and cost-effectiveness within their operations.

How Terrascope can help businesses navigate climate regulations

Terrascope is an end-to-end decarbonisation platform that helps businesses measure and manage their carbon emissions. We can simplify and accelerate the effort of compliance, using machine learning and AI capabilities through:

- Assimilating data from across complex supply chains;

- Filling data gaps in data to provide accurate and comprehensive carbon emission calculations across Scopes 1, 2 and 3;

- Helping businesses understand their carbon emissions, broken down by product, geography, process, and more.

- Helping businesses create the business case for sustainability and drive actionable change in operations, avoiding legal or regulatory penalties.

In particular, the Australian Government’s proposal to require businesses to make climate-related financial reporting spell some major changes for Australian businesses, and Terrascope can help facilitate this transition.

%20(2).png)