Summary

- Over 90% of CEOs worldwide prioritize sustainability, highlighting carbon accounting as essential for managing emissions and meeting regulatory demands.

- Carbon accounting quantifies greenhouse gas emissions, focusing on Scope 1, 2, and 3 emissions, to assess an organization's carbon footprint.

- Despite challenges in data collection and accuracy, carbon accounting offers opportunities for improved sustainability, stakeholder engagement, and regulatory compliance.

Introduction

Amidst environmental worries and climate change, consumers, investors, and CEOs emphasise mindful environmental business practices. A World Economic Forum study found that over 90% of CEOs prioritise sustainability, highlighting the need for carbon accounting to meet evolving demands and regulatory shifts. Carbon accounting has emerged as a crucial tool for businesses to measure, manage, and disclose their carbon emissions. In this blog, we provide an in-depth overview of carbon accounting: its definition, the process of conducting carbon accounting, the challenges involved, and the opportunities it presents.

What is carbon accounting?

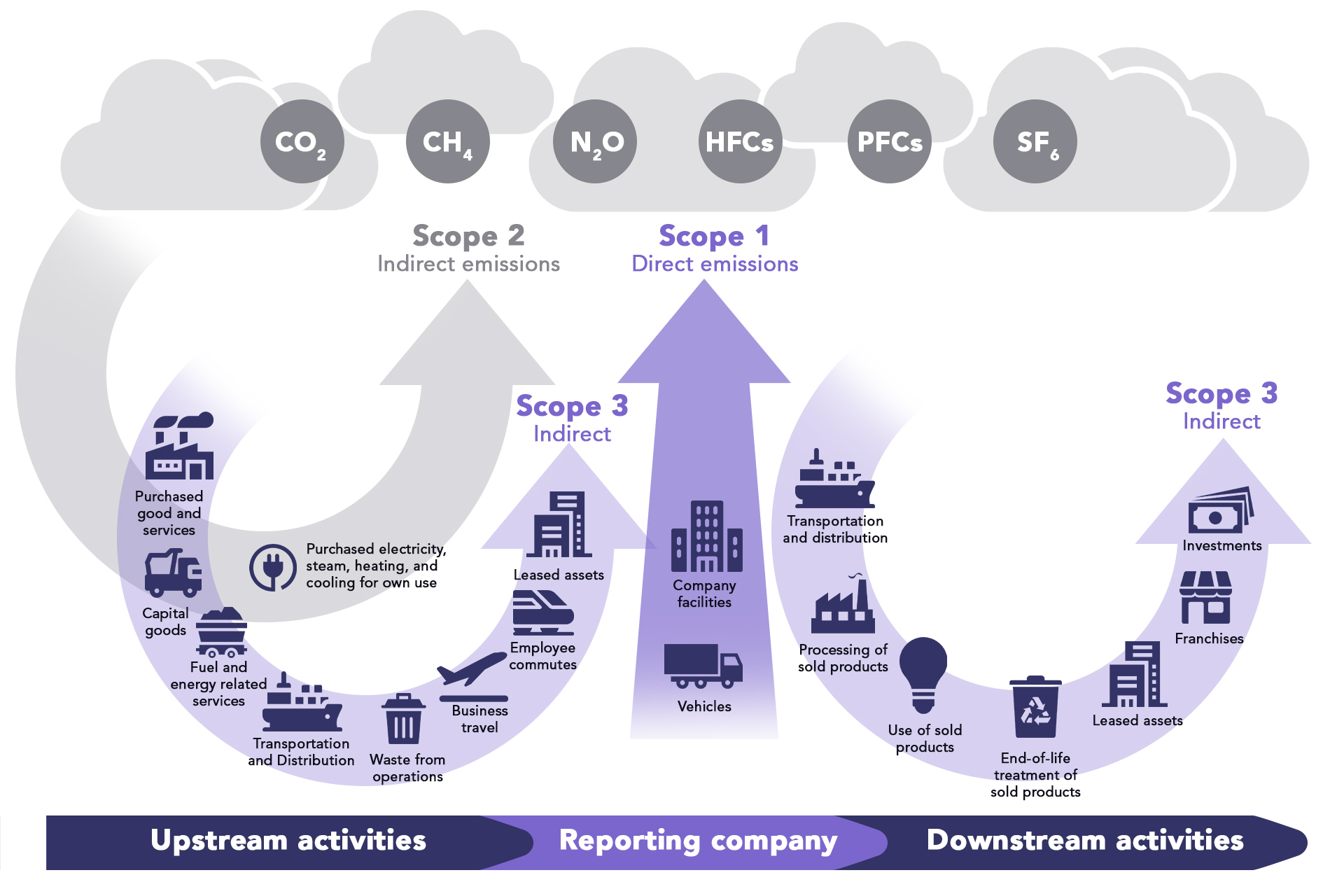

Carbon accounting refers to the process of quantifying and documenting the greenhouse gas (GHG) emissions produced by an organisation or enterprise. The primary greenhouse gas of concern is carbon dioxide (CO2), but other gases like methane (CH4), nitrous oxide (N2O), and fluorinated gases are also considered in the assessment. While emissions may be the result of any of these gasses, the standard unit for measuring emissions is CO2e (carbon dioxide equivalent) - a unified way to express the contribution of each GHG to climate change. The goal of carbon accounting is to determine an organisation's carbon footprint, which reflects its contribution to climate change.

How is carbon accounting done?

The process of carbon accounting involves a systematic approach to quantifying and documenting a company’s greenhouse gas emissions. The first step in carbon accounting involves identifying and categorising the sources of emissions within the organisation. These emission sources are categorised into three scopes:

- Scope 1: Direct emissions from sources that are owned or controlled by the organisation, such as emissions from the combustion of fossil fuels in company-owned factories and facilities.

- Scope 2: Indirect emissions from purchased electricity or heating.

- Scope 3: Indirect emissions that occur because of the organisation's activities, but from sources not owned or controlled by them. This includes emissions from the entire value chain, including suppliers, transportation, and even customer use of products.

Once the sources are identified, data management takes place. Business data is collected and processed from the company’s various internal departments and across all value chains. The data is then profiled through matching with appropriate emission factors that specify the associated estimated amount of greenhouse gas emissions involved.

The next step is the measurement of emissions, for which companies must establish a baseline of their Scope 1, 2 and 3 emissions. For effective carbon accounting, businesses must obtain accurate and comprehensive measurements across all scopes of emissions. While enterprises have more control over their Scope 1 and 2 emissions, measuring their Scope 3 emissions is challenging.

Dialling in on calculating Scope 3 emissions, there are a variety of methodologies that companies can utilise, hinging on industry averages, proxies, and other sources. Enterprises are advised to select methods which ensure that the inventory appropriately reflects the GHG emissions of the activities and serve the decision-making needs both internally and externally.

The final step in the carbon accounting process is reporting and verifying data. This means that emissions data is compiled into reports and disclosed to stakeholders such as investors, customers, and regulatory authorities. External verification and assurance of the reported carbon accounting data may be conducted to enhance credibility. Businesses can use frameworks such as the Greenhouse Gas (GHG) Protocol Corporate Standard to report their emissions data.

Challenges in carbon accounting

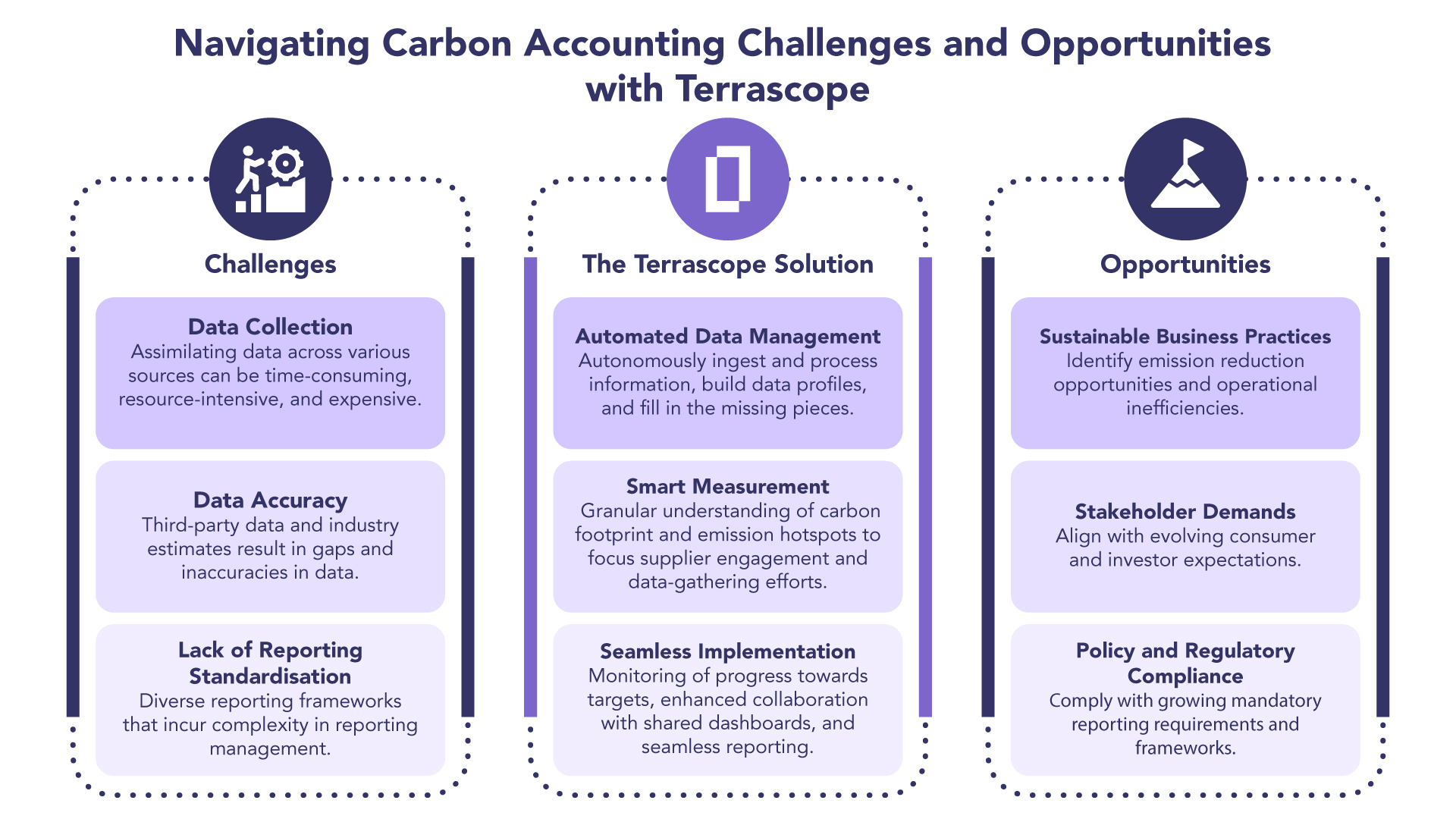

While carbon accounting plays a pivotal role in addressing climate change and promoting sustainable business practices, it is not without its challenges. Some of the key challenges that businesses may face when quantifying GHG emissions are:

- Data collection: One of the major challenges in carbon accounting is obtaining accurate and comprehensive data from various sources. This requires cooperation from all departments and may be resource-intensive and expensive for some enterprises. Many suppliers also may not measure their emissions at all, and those who do measure, may not be open to sharing data due to confidentiality or contractual issues.

- Data accuracy: Ensuring data accuracy is crucial for credible carbon accounting. Businesses that are unable to collect granular data will have to rely on estimate data and industry averages to calculate their emissions. This can lead to inconsistent and inaccurate data, which in turn can lead to misinformed decision-making.

- Lack of reporting standardisation: A universally accepted standard for carbon accounting is lacking, resulting in a diversity of reporting frameworks including the Global Reporting Initiative (GRI), Task Force on Climate-Related Financial Disclosures (TCFD), International Sustainability Standards Board (ISSB), Carbon Disclosure Project (CDP), and the upcoming European Sustainability Reporting Standards (ESRS). Notably, the ISSB mandates usage of the GHG Protocol Corporate Standard for GHG accounting, whereas the CDP permits alternative methods like ISO 14064-1 or national methodologies. This array of approaches can complicate the management of reporting.

Carbon accounting as an opportunity

While there are challenges on the path to robust carbon accounting for businesses, there are also a wealth of opportunities. There are several ways in which businesses can benefit from committing to carbon accounting practices, including -

- Sustainable business practices: Carbon accounting allows businesses to identify emission reduction opportunities and operational inefficiencies. By understanding their carbon footprint, businesses can take targeted actions to reduce emissions as well as improve operational resilience.

- Stakeholder demands: Investors and customers are increasingly demanding transparency and accountability regarding the carbon footprints of the businesses they invest in. By embracing carbon accounting and disclosing emissions data, businesses can adhere to the changing consumer landscape and also attract environmentally conscious investors, gaining a competitive advantage in the market.

- Benchmarking and accountability: Carbon accounting gives businesses the opportunity to understand and analyse their sustainability performance relative to previous years. Companies can use benchmarking to assess their environmental impact as well as the effectiveness of their decarbonisation strategies. By investing in carbon accounting, enterprises can be accountable not only to investors, consumers and regulators but to themselves as well.

- Policy and Regulatory Compliance: Many countries and regions are implementing mandatory reporting requirements and regulatory frameworks related to carbon emissions. Carbon accounting will help businesses align with these regulations and demonstrate their commitment to environmental responsibility. This will also help them avoid any potential legal, financial, or reputational penalties for non-compliance. Moreover, participation in voluntary initiatives and carbon markets can create additional opportunities for businesses to offset emissions and contribute to carbon neutrality.

How can Terrascope help?

Terrascope’s end-to-end decarbonisation platform can play a vital role in simplifying the carbon accounting process for businesses. Through machine learning and advanced data analytics and reporting tools, Terrascope can streamline data collection, analysis, and reporting, ensuring accurate and transparent carbon accounting down the line. Exemplifying this, Terrascope was able to help UK-based food and beverage company Princes build operational resilience with data ingestion that was five times faster than manual processes. Terrascope improved Princes’ ability to make timely data-driven decisions and make significant progress in their decarbonisation efforts.

Terrascope can also provide insights and recommendations to help businesses identify emission reduction opportunities and integrate carbon accounting into their decarbonisation strategies. For example, Terrascope was able to help MC Agri Alliance optimise its supply chain for a potential 25% reduction in scope 3 emissions through reduction scenarios.

Carbon accounting has emerged as a critical practice for businesses to measure and manage their environmental impact, particularly regarding greenhouse gas emissions. With carbon accounting, organisations can identify areas for improvement, enhance sustainability efforts, and meet the demands of various stakeholders and regulations. Despite the challenges, the opportunities that carbon accounting presents for sustainable business practices, compliance with regulations, and market differentiation make it an essential aspect of responsible corporate conduct in the fight against climate change.

Quick answers to questions you may have:

1. What is carbon accounting?

Carbon accounting is the process of quantifying an organisation's greenhouse gas emissions to assess its environmental impact. It involves tracking and reporting emissions, including carbon dioxide and other greenhouse gases, to promote sustainable practices and meet regulatory requirements.

2. Why is carbon accounting important for businesses?

Carbon accounting helps businesses understand their carbon footprint and environmental impact, enabling them to implement emission reduction strategies, meet stakeholder expectations, and comply with regulations.

3. What are Scope 3 emissions?

Scope 3 emissions are indirect emissions that occur outside an organisation's direct control, including emissions from its value chain, such as suppliers, transportation, and customer use of products.

4. How can Terrascope assist businesses with carbon accounting?

Terrascope provides a specialised carbon accounting platform that simplifies data collection, analysis, and reporting, helping businesses make informed decisions to reduce their carbon footprint and integrate sustainability into their operations.

5. How does carbon accounting benefit investors and customers?

Carbon accounting demonstrates a business's commitment to sustainability, making it an attractive option for environmentally-conscious investors and customers seeking eco-friendly products and services.

6. Does carbon accounting include non-CO2 greenhouse gases?

Carbon accounting considers various greenhouse gases, including methane (CH4), nitrous oxide (N2O), and fluorinated gases, to provide a comprehensive assessment of emissions.

7. Is carbon accounting only relevant for environmentally-intensive industries?

No, carbon accounting is relevant for all industries, regardless of their environmental impact. It helps organisations across sectors identify opportunities for emission reduction and sustainability improvements.